income tax rates 2022 south africa

Tax rates for the year of assessment. 8 rows Tax rates from 1 March 2021 to 28 February 2022.

How To Calculate Income Tax In Excel

Personal Income Tax Rate in South Africa is expected to reach 4500 percent by the end of 2020 according to Trading Economics global macro models and analysts expectations.

. For Individuals Trust. 7 rows 23 February 2022 See the changes from the previous year. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201 R337 800 R38 916 26 of taxable income above R216 200.

2022 2023 Tax Year. The amount above which income tax becomes payable is R135 150. 40 680 26 of taxable income above 226 000.

This change in the corporate tax rate triggers the recent amendment of section 20 of the Income Tax Act No. Updated January 2022. Income Tax Rates and Thresholds.

Details of the personal income tax rates used in the 2022 Virginia State Calculator are published below the The West Virginia Legislature passed pay raises for all state employees. Use our free online income tax calculator to work out your monthly take-home pay and view the income tax tables for individuals for the 2023 tax year. 2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000.

Capital Gains Tax CGT See here how the changes in tax rates affect the age groups per income level from last year to this year. Depreciation allowances also referred to as wear-and-tear allowances are granted by SARS for certain qualifying assets. In this section you will find the tax rates for the past few years for.

7 rows South Africa Residents Income Tax Tables in 2022. 2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa. 1 day agoThe South Carolina Freedom of Information Act provides that all compensation for employees with earnings equaling 000 or more annually may be released.

353 101 488 700. You are viewing the income tax rates thresholds and allowances for the 2022 Tax Year in South Africa. International Tax South Africa Highlights 2022.

In the 2021 budget speech the former finance minister announced that the corporate income tax rate would be reduced by one percentage point to 27 for companies with a year of assessment commencing on or after 1 April 2022. Non-residents are taxed on their South African sourced income. 2021 and 2022 tax years.

Businesses and depreciation allowances. If you are 65 years of age to below 75 years the tax threshold ie. For taxpayers aged 75 years and older this threshold is R151 100.

Credit is granted in South Africa for foreign taxes paid. 58 of 1962 with the. 73726 31 of taxable income above 353100.

For the 2022 year of assessment 1 March 2021 28 February 2022 R87 300 if you are younger than 65 years. 2023 2022 2021 2020 2019 2018 2017 2016 2015 etc. Information is recorded from current tax year to oldest eg.

You are viewing the income tax rates thresholds and allowances for the 2023 Tax Year in South Africa. Tax rates year of assessment ending 28 February 2023 Taxable Income R Rate of Tax R 1 226 000. Tax rates are proposed by the Minister of Finance in the annual Budget Speech and fixed or passed by Parliament each year.

A new tax reality Budget 2021 3 Tax Rates year of assessment ending 28 February 2022 TaxThresholds Age Threshold Below age 65 R87 300 Age 65 to below 75 R135 150 Age 75 and older R151 100 Trusts other than special trusts will be taxed at a flat rate of 45. 1 March 202128 February 2022 Individual income tax rate Taxable income ZAR Rate. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201 R337 800 R38 916 26 of taxable income above R216 200.

For the latest tax developments relating to South Africa see. Taxable Income R Rates of Tax. 18 of taxable income.

South Africa Personal Income Tax Rate - values historical data and charts - was last updated on May of 2022. The same rates of tax are applicable to both residents and non-residents. Information is recorded from current tax year to oldest eg.

In the National Budget Speech Minister of Finance Enoch Godongwana announced that the corporate tax rate will be reduced to from 28 to 27 with effect from years of assessment commencing on or after 1 April 2022. Taxable Income R Rate of Tax R 1 91 250 0 of taxable income 91 251 365 000 7 of taxable income above 91 250 365 001 550 000 19 163 21 of taxable income above 365 000 550 001 and above 58 013 28 of the amount above 550 000. 40680 26 of taxable income above 226000.

Taxable income R Rates of tax. Individual - Taxes on personal income. South African residents are taxed on their worldwide income.

For more information on tax rates see the Budget webpage. The income-tax rates for Assessment Year 2023-24 are the same as applicable in Assessment Year 2022-23 with However the rate of surcharge on long-term capital gain and AOP consisting of only company as member is capped at 15. Taxable income Rates of tax R0 R216 200 18 of each R1 of taxable income.

2021 and 2022 tax years. 1216200 18 of taxable income 216201337800 38916 26 of taxable. If you are looking for an alternative tax year please select one below.

The below table shows the personal income tax rates from 1 March 2022 to 28 February 2023 for individuals and trusts in South Africa. 2023 2022 2021 2020 2019 2018 2017 2016 2015 etc. 226 001 353 100.

40680 26 of taxable income above 226000. Years of assessment ending on any date between 1 April 2022 and 30 March 2023. Last reviewed - 16 March 2022.

2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. 18 of taxable income. 18 of taxable income 226001 - 353100.

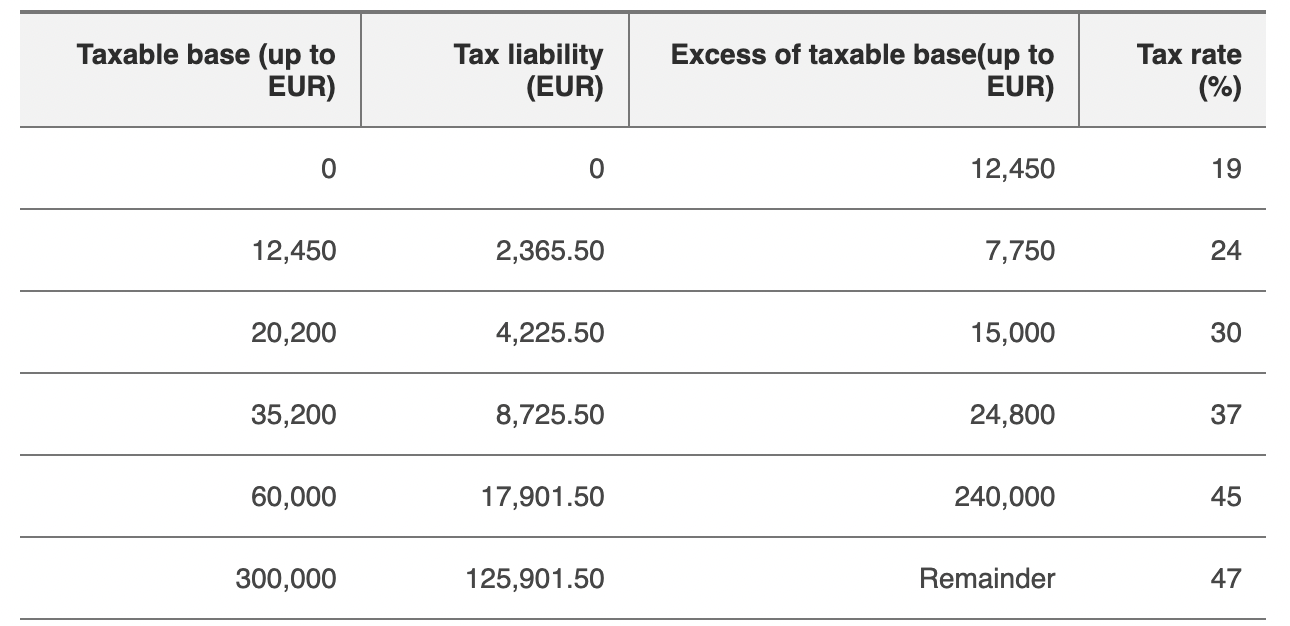

Calculation Of Personal Income Tax Liability Download Scientific Diagram

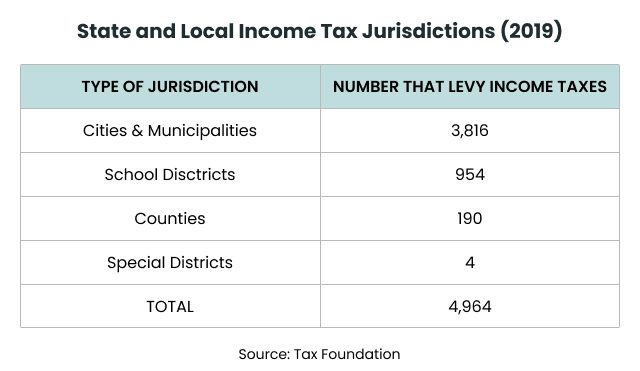

Who Pays U S Income Tax And How Much Pew Research Center

Corporate Income Tax Definition Taxedu Tax Foundation

Who Pays U S Income Tax And How Much Pew Research Center

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Definition What Are Income Taxes How Do They Work

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

Corporate Income Tax Definition Taxedu Tax Foundation

Income Tax Brackets For 2022 Are Set

Progressive Tax Definition Taxedu Tax Foundation

Income Tax Brackets For 2022 Are Set

Calculation Of Personal Income Tax Liability Download Scientific Diagram

How To Calculate Income Tax In Excel

How To Create An Income Tax Calculator In Excel Youtube

State Income Tax Rates Highest Lowest 2021 Changes

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

:max_bytes(150000):strip_icc()/ScreenShot2021-05-17at12.36.12PM-22c6287a600548be8be11533f7eed51b.png)